IIMS seminar series "Institutional Problems of the Russian Economy"

On May 26, Shweta Sikhwal spoke at the most recent seminar of the resumed series.

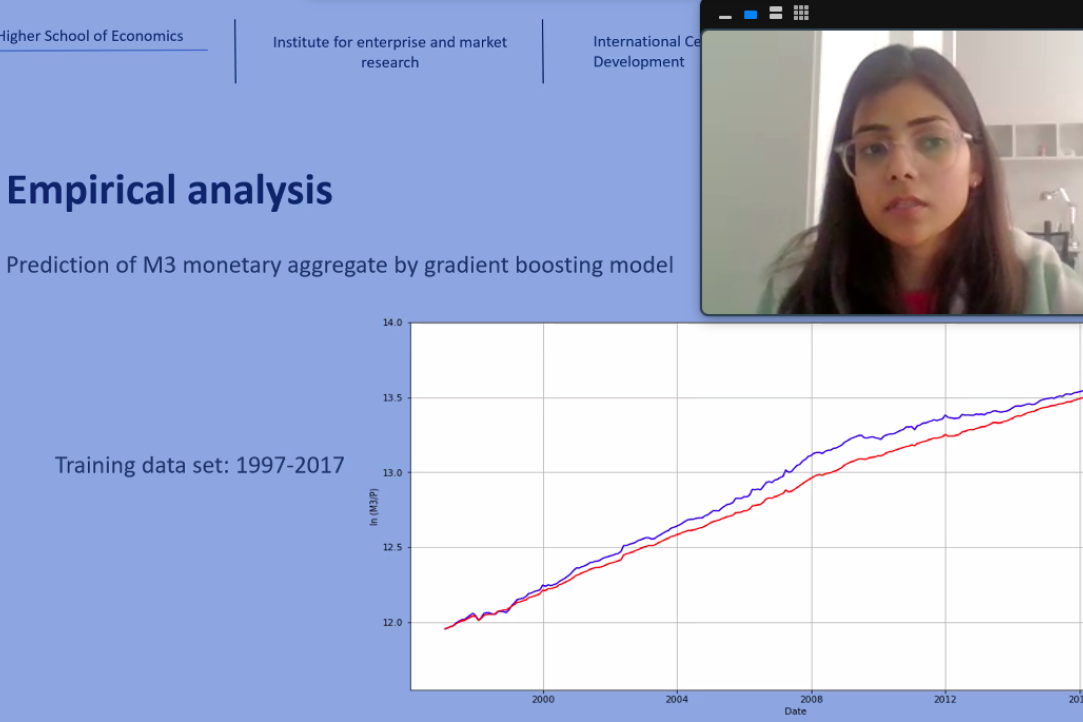

Shweta Sikhwal (Research Assistant, ICSID) presented the paper co-authored with Sreenjay Sen "Can machine learning models provide a better forecast of money demand? Evidence from the Indian economy".

Abstract. Money demand has been a subject of empirical research due to it the instability in the money demand function. The study attempts to find a better forecast model by exploring the machine learning models. An accurate prediction of money demand can serve the goal of inflation targeting of the central bank of India. Specifically, the research focuses on the random forest regression, gradient boosting and Xtreme-gradient boost method for the prediction of money demand for the Indian economy for a monthly dataset from 1997 to 2021. The results indicate the machine learning models perform fairly good for predicting both the narrow money demand and broad money demand. The results from the ML models are then compared with the traditional econometric approach namely ARDL. The forecasted values from ARDL deviate significantly from the actual values proving that ML models could provide a better forecast of money demand.